Time weighted rate of return

TWRR ignores the effects of timing and size of cash flow from. The time-weighted return of an investment is a relatively simple calculation to show investors what percentage returns.

Time Weighted Return Explained Smartasset

For example if the internal rate of return on each regular time interval is 4 9.

. Time-Weighted Rate of Return Calculator. The time-weighted rate of return TWR is a measure of the compound rate of growth in a portfolio. The internal rate of return is estimated over regular time intervals and then the results are linked geometrically.

Time-weighted rate of return TWRR measures your accounts performance over a certain period of time. It segregates the return on a portfolio into separate sub-periods. Thus the time-weighted return on this portfolio is of 2840 Conclusion Both methods are useful in evaluating the performance of an investment portfolio over time.

TWR Time-Weighted Return n Number of Periods HP End Value Initial Value Cashflow Initial Value Cashflow HPn Return for Period n Now lets try to. 1 D64 - 1. What Is Time-Weighted Rate of Return TWR TWRR.

According to the CFA Institute Time-weighted rate of return allows the evaluation of investment management skill between any two time periods without regard to the total amount invested. Time-weighted rate of return TWRR or TWR is a method for calculating the compound growth rate of an investment portfolio. The time-weighted rate of return TWRR also known as a geometric mean return is a portfolio performance benchmark that calculates the compound rate of return of 1 invested.

I assume the deposit is added to the account at the end of the period after the gain or loss is added to the balance each month. When it comes to calculating rates of return the time-weighted rate of return is your Holy Grail of portfolio performance benchmarking. Because it completely eliminates the.

The TWR measure is much of the time used to compare the returns of investment. 1 2814 1 6821 1 982 So Meredith and Kathyrns time-weighted return is the same even though their personal returns differ by 18103. Mouse over any fields if you require clarification or instruction.

When many transactions are happening in the investment. The time-weighted rate of return TWR measures the rate of return of a portfolio by eliminating the distorting effects of changes in cash flows. To get started simply fill in the form below OR load a file with previous calculations.

To apply the time-weighted return method combine the returns over sub-periods by compounding them together. More Discounted Cash Flow. The time-weighted return TWR is a method of calculating investment return.

1 D6 13 - 1. The time-weighted rate of return is a technique for estimating an investment portfolios compound growth rate.

Time Weighted Return Explained Smartasset

Investment Performance

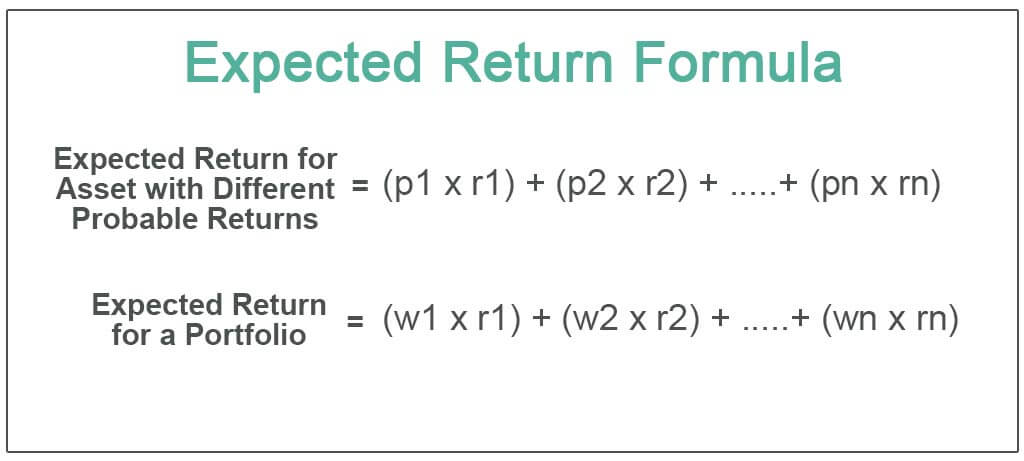

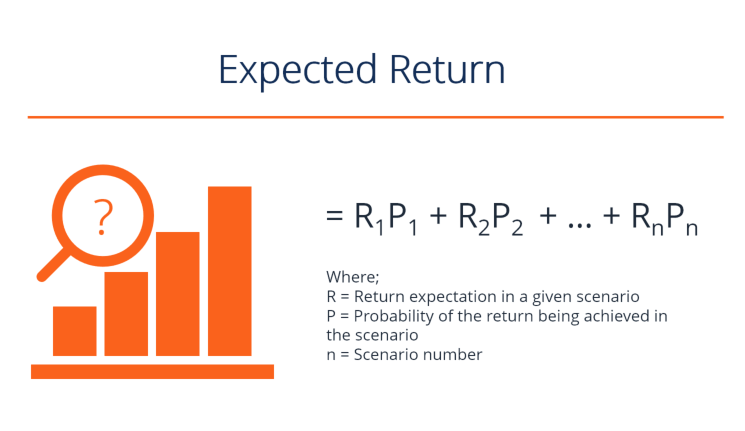

Expected Return Formula Calculate Portfolio Expected Return Example

Time Weighted And Dollar Weighted Returns Financial Edge

Time Weighted Vs Money Weighted Rates Of Return

Internal Rate Of Return Irr Formula And Calculator

Time Weighted Vs Money Weighted Rates Of Return

Difference Between Time Weighted Returns And Money Weighted Returns

Time Weighted Vs Money Weighted Rates Of Return

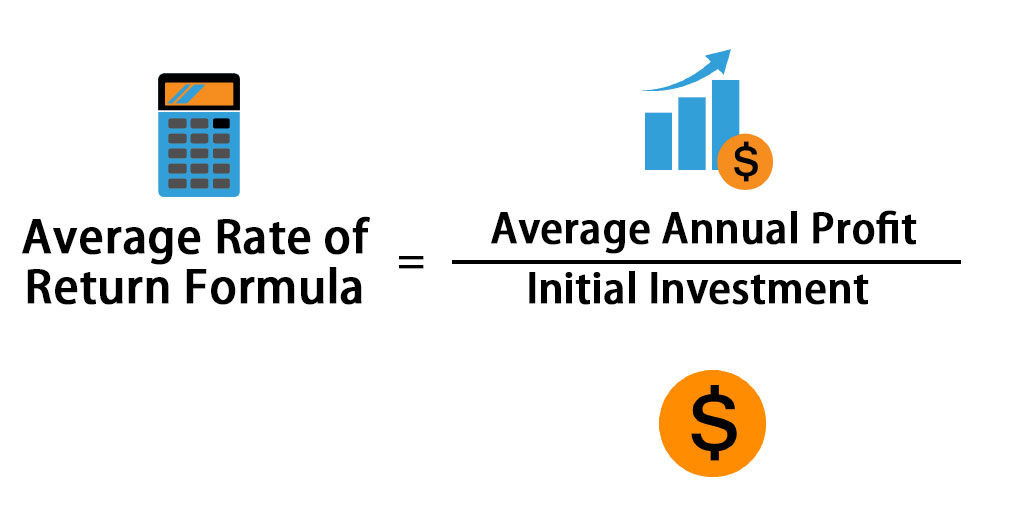

Average Rate Of Return Formula Calculator Excel Template

Time Value Of Money Explained Meaning Formula Examples

Portfolio Return Formula Calculator Examples With Excel Template

Geometric Mean Return Definition Formula How To Calculate

/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

Dollar Weighted Rate Of Return Definition Formula Video Lesson Transcript Study Com

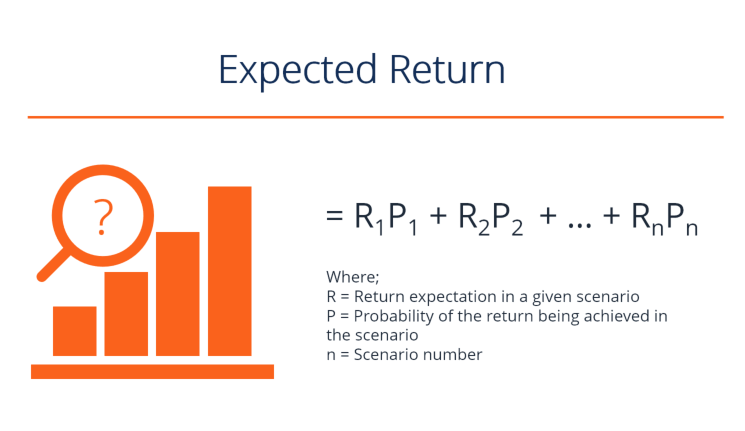

Expected Return How To Calculate A Portfolio S Expected Return

Dollar Weighted Rate Of Return Definition Formula Video Lesson Transcript Study Com