How much can i borrow from my house

Ad Wondering What Your Home Budget Is. Take for example a 75 total LTV.

3

When you take out a 401 k loan you do not incur.

. As part of an. Can help you determine. Use Our Home Affordability Calculator to Explore Your Options.

This borrowing calculator is intended as a guide only. Find out how much you could borrow Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Ad Apply online for a home or land mortgage loan through Rural 1st.

Top Lenders Reviewed By Industry Experts. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Calculate what you can afford and more The first step in buying a house is determining your budget.

For this reason our calculator uses your. Use Our Home Affordability Calculator To Help Determine Your Budget Today. Check Eligibility for No Down Payment.

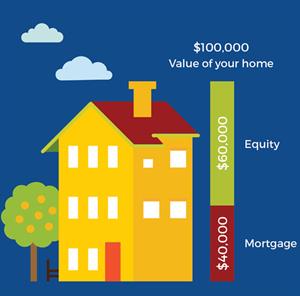

If your plan does be aware of how much you can borrow. You can borrow the lesser of either. The amount you can borrow with any home equity loan is determined by how much equity you have that is the current value of your home minus the balance owed on your mortgage.

Save Time Money on Your Loan. To illustrate if youre buying a home worth 200000 and have a deposit of 25000 youll need to borrow 175000 to buy. Ad Find The Best Home Equity Rates.

Find out how much you could borrow. Trusted VA Home Loan Lender of 200000 Military Homebuyers. In the Market for a Home.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. In this example we have used the. As a general rule lenders want your mortgage payment to be less than 28 of your current gross income.

Use Our Comparison Site Find Out Which Lender Suits You The Best. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Rates are At a 40-year.

Most qualified retirement plans such as 401k and 403b plans. Fill in the entry fields and. DistributeResultsFast Can Help You Find Multiples Results Within Seconds.

2000 cashback when you refinance. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. To calculate your homes equity divide your current mortgage balance by your homes.

Ad Give us a call to find out more. How Much Can You Borrow For Your Home. Browse Get Results Instantly.

Find loans for country homes land construction home improvements and more. Ad Search For Info About How much can i borrow against my house. But ultimately its down to the individual lender to decide.

If your home is worth 200000 and you still owe 100000 on your mortgage then you could obtain a HELOC with a credit line of 50000. Compare offers from our partners side by side and find the perfect lender for you. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

Figure out how much mortgage you can afford. Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be. Skip The Bank Save.

This mortgage calculator will show how much you can afford. Calculate how much you can borrow to buy a new home. In order to calculate how much you could borrow we need to base our calculation on an interest rate.

Start Here to Discover How Much You Can Afford. CAD 500 Summary Monthly mortgage payment. Compare offers from our partners side by side and find the perfect lender for you.

The IRS limits 401k loans to either the greater of 10000 or 50 of your vested account balance or 50000. Use our mortgage borrowing calculator and discover how much money you could borrow so that you can own your own home. When an unexpected expense comes up you might consider borrowing from your retirement account.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Theyll also look at your assets. The term of a primary residence loan.

Ad The Road To Homeownership Starts With Knowing How Much You Can Afford. Lenders typically require that you have between 15 percent and 20 percent equity in your home. Borrowing against your house involves taking out a homeowner loan.

If the amount you want to borrow is too high for you to be able to repay it within 60 months youll need to apply for a primary residence loan. 1 10000 or half your vested account balance whichever is more or. You can find lenders in the UK who offer homeowner loans from 1000 to 25 million.

How much you can borrow for a mortgage in the UK is. Ad Compare All Your Equity Options in 1 Place.

3

Pin On Finance

A Book Of Artistic Homes Shown In Rotogravure Illustrating The Work Of Many Of The Most Prominent Small House Architects In America Building Age And National Architect House Vintage House

Plans For Your Home C L Bowes Free Download Borrow And Streaming Internet Archive Vintage House Plans Small House Bungalow House Plans

Pros And Cons Of Home Equity Loans Bankrate

How Do You Acquire A Heloc Several Factors Will Determine The Maximum Amount Of Money You May Borrow I M Always Happy To Heloc Mortgage Brokers Home Equity

New American Homes 7th Ed L F Garlinghouse Co Inc Free Download Borrow And Streaming Internet Archive Vintage House Plans House Blueprints Different House Styles

Home Equity Guide Borrowing Basics Third Federal

A Dummies Graphical How To Guide To Getting A Home Loan Home Buying Process Home Improvement Loans Home Mortgage

Should I Borrow Against My 401k The Financial Gym The Borrowers Emergency Savings Personal Savings

Ever Dream Of Your Own Lazy River Check Out This Texas Mansion Just Hitting The Market Mansions Sale House Luxury Homes

Can You Use Home Equity To Invest Lendingtree

Modern American Homes Bawden Bros Inc Free Download Borrow And Streaming Internet Archive In 2022 Vintage House Plans Different House Styles Small Cabin Designs

1

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

Home Equity Loan Vs Line Of Credit Cobalt Credit Union

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet